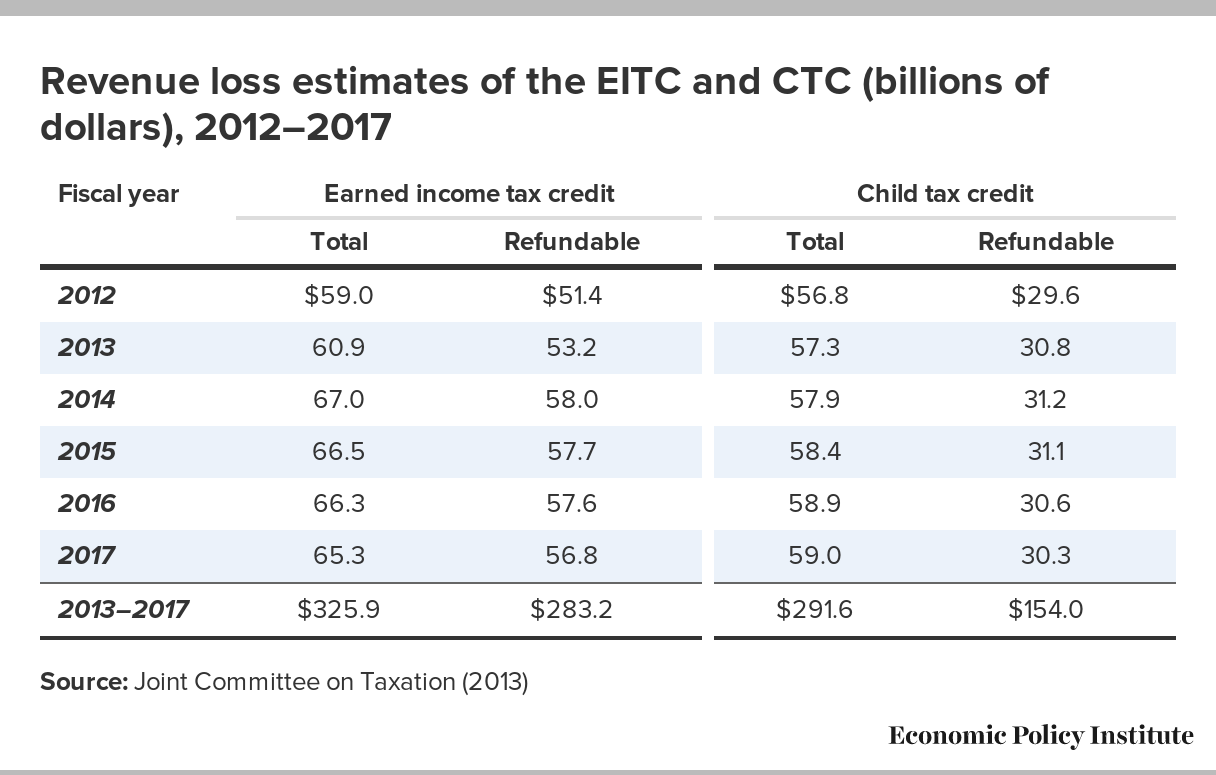

Ctc For 2025 Tax Year - President joe biden’s budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan. Child Tax Credit 2025 Married Couple with CTC Phaseouts YouTube, The amount of your child tax. The new provisions increase the maximum refundable amount per child to $1,800.

President joe biden’s budget proposal for the 2025 fiscal year calls for fully restoring the child tax credit (ctc) enacted in the american rescue plan.

How will the child tax credit change in 2025. Get help filing your taxes and find more information about the 2021 child tax credit.

3600 Child Tax Credit 2025 Check CTC Eligibility & How To Claim Online?, Currently, the maximum refundable ctc is limited to $1,600 per child for 2025. The additional child tax credit allows you to receive up to $1,600 of the $2,000 ctc per child as a refund for 2025 and 2025.

Senior lawmakers in congress announced a bipartisan deal tuesday to expand the child tax credit and provide a series of tax breaks for businesses.

The new provisions increase the maximum refundable amount per child to $1,800.

The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

Child Tax Credit The Child Tax Credit Ctc A Primer Tax Foundation, The additional child tax credit allows you to receive up to $1,600 of the $2,000 ctc per child as a refund for 2025 and 2025. But the expanded ctc failed to materialize ahead of the april 15 tax deadline, and its future appears uncertain.

Tax Brackets 2025 India Old Regime Nita Krystalle, The additional child tax credit allows you to receive up to $1,600 of the $2,000 ctc per child as a refund for 2025 and 2025. A bill to expand the child tax credit (ctc) — a major biden priority that provides money for working families — and to restore certain corporate tax breaks.

Tax Thresholds 2025 25 Image to u, Biden aims to revive monthly child tax credit payments in 2025 budget plan. On january 19, 2025, the house ways and means committee approved the tax relief for american families and.

Tax Refund Update 2025 Pending Changes to the CTC YouTube, The tax credit is based on income, requiring that parents earn at. Biden aims to revive monthly child tax credit payments in 2025 budget plan.

Senior lawmakers in congress announced a bipartisan deal tuesday to expand the child tax credit and provide a series of tax breaks for businesses. But the expanded ctc failed to materialize ahead of the april 15 tax deadline, and its future appears uncertain.

Child Tax Credit CTC Update 2025, These tables show rates and allowances for tax credits, child benefit and guardian’s allowance by tax year (6 april to 5 april). Senior lawmakers in congress announced a bipartisan deal tuesday to expand the child tax credit and provide a series of tax breaks for businesses.

Ctc For Taxes Filed In 2025 Deena Marcelline, But the expanded ctc failed to materialize ahead of the april 15 tax deadline, and its future appears uncertain. The ctc cut child poverty in half.

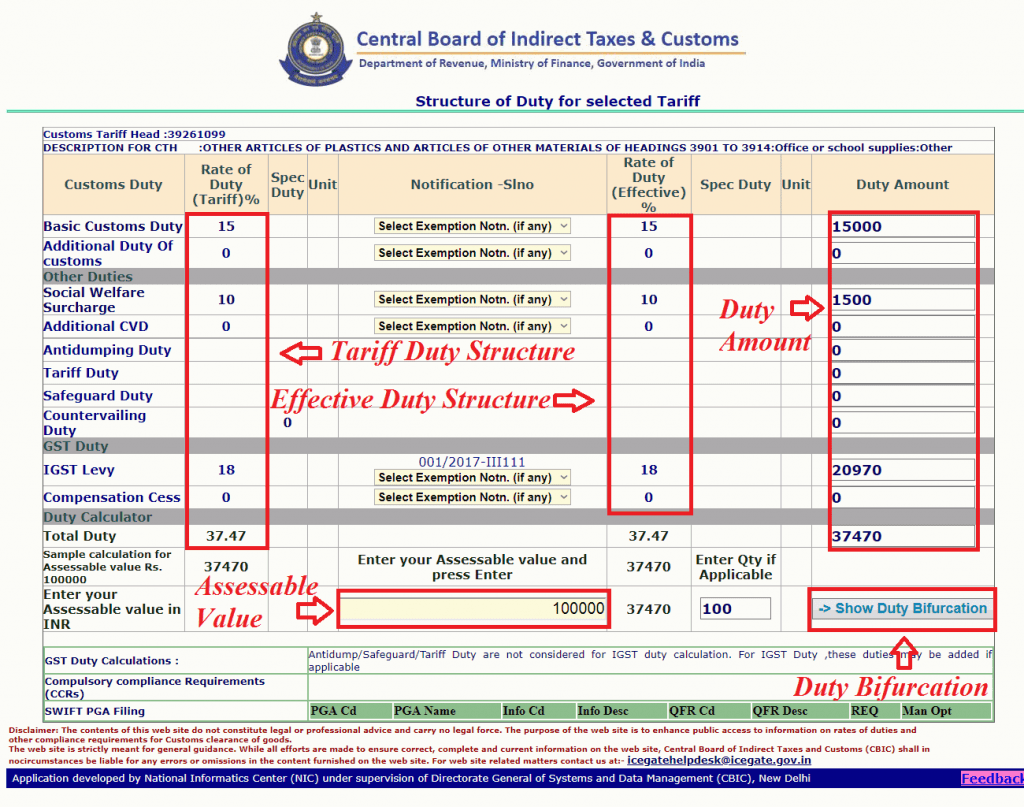

How To Calculate Customs Duty In India? » 2025, Senior lawmakers in congress announced a bipartisan deal tuesday to expand the child tax credit and provide a series of tax breaks for businesses. But the expanded ctc failed to materialize ahead of the april 15 tax deadline, and its future appears uncertain.

Ctc Tax Table 2025 Pdf Gabbey Emmalee, The bill, called the tax relief for american. On january 19, 2025, the house ways and means committee approved the tax relief for american families and.